Healthcare in Canada

If you’re planning a move to Canada, you’ve got lots to be excited about. This beautiful nation is home to some of the world’s most stunning scenery (it’s known as the “Great White North” for a reason).

However, before you can daydream about mountains and lakes, you need to sort out the serious stuff – like healthcare. How does Canada’s healthcare system work? Can expats use it, and do you need private medical cover? On this page, we’ll answer all these questions and more.

Want to find out exactly how much a private health insurance policy will cost you and your family in Canada? You can start building a customised plan via Cigna. With over 95 million customers worldwide, Cigna has the reliability and the know-how to get you sorted with the right policy.

Canadian healthcare: key stats

- 0Average life expectancy

- 0% of healthcare spending on private services

- 0World healthcare ranking /100

What’s on this page?

01 | How does the Canadian healthcare system work?

02 | Do people have health insurance in Canada?

03 | Who is eligible for free Canadian healthcare?

04 | Is private health insurance worth it in Canada?

05 | How much does Canadian private medical cover cost?

06 | COVID-19 in Canada

07 | Advice for expats moving to Canada

How does the Canadian healthcare system work?

Despite being America’s next-door neighbour, Canada’s healthcare system is very similar to the UK’s. The Canadian government uses tax income to provide “free” essential medical services. It’s basically ‘NHS Canada’, although its official name is Medicare (not to be confused with American or Australian Medicare).

However, Canada doesn’t take a centralised approach like the UK. The country is made up of 10 provinces and 3 territories, and each provincial/territorial government is responsible for dispensing its own healthcare services. This is why the standard of care – and the extent of medical cover – can vary region by region.

Another difference between Canada and the UK is that Canadian hospitals are not state-run. Almost all healthcare in Canada is provided by private companies, who are then paid by the government directly.

So is there free healthcare in Canada?

Essentially, yes. Canadian residents pay for Medicare through their taxes, but the medical services are free at the point of use.

However, Medicare doesn’t cover everything (as we discuss below), which is why private health insurance is popular in Canada.

30% of the nation’s healthcare spending goes on private services, with private cover often provided by an employer.

How exactly is Canada’s healthcare funded?

There is no specific “healthcare tax” in Canada, so the government uses a proper cocktail of taxes to fund healthcare, including income taxes, sales taxes, property taxes, import duties, Employment Insurance (EI), and so on.

The average Canadian pays thousands of dollars in taxes for healthcare each year. The income tax rates in Canada for 2023 are as follows:

| Income | Tax rate |

|---|---|

| C$0 - C$53,359 | 15% |

| C$53,360 - C$106,717 | 20.5% |

| C$106,718 - C$165,430 | 26% |

| C$165,431 - C$235,675 | 29% |

| C$235,676+ | 33% |

What does Canadian Medicare cover?

Crucially, Canadian healthcare covers only “medically necessary and hospital physician services”. However, the federal government doesn’t specify what exactly counts as “medically necessary” – it’s left up to the provincial and territorial governments to decide.

Regional Medicare plans (also known as provincial health insurance plans) typically cover:

- Emergency hospital treatment

- Most primary and secondary care, i.e. any medically necessary services to help diagnose and treat any injuries/illnesses

- Maternity services (including prenatal and postnatal care)

Whenever you use Medicare services, you are not billed directly (the bills go to the government), and there are no ‘deductibles’ (i.e. excesses) to pay.

Emerald Lake in Yoho National Park, British Columbia

What does Canadian Medicare not cover?

Here are some examples of services that provincial health insurance plans typically don’t cover:

- Prescription medicine

- Ambulance services (except in the Yukon Territory)

- Dental care

- Eye care

- Hearing aids

- Physiotherapy

- Limb prostheses

- Psychologist care

- Chiropractics

- Tests required for official documents (e.g. driver’s license)

Of course, this is not a perfectly accurate picture of every provincial health insurance plan, as they can vary somewhat. Many of the items on the list are covered by Medicare for children, over-65s, and people on low incomes.

Paying for prescription medicine in Canada

Canada is the only country in the ‘developed world’ that offers universal healthcare without any kind of provision (or even subsidy) for prescription medicine. This kind of provision is often known as ‘pharmacare’.

And it has a big impact on Canadian wellbeing – in fact, it’s been found that one in four Canadian households struggle to fill needed prescriptions.

Canadians pay the third highest drug costs among Organisation for Economic Co-operation and Development (OECD) countries – and it shows. In a 2019 study, some participants stated that in order to afford prescriptions, they “either cut back on general needs such as food, clothing, car, leisure-related activities, or other healthcare supplies”.

Want a better idea of how much private medical insurance will cost you and your family in Canada? Start building a customised plan with Cigna.

So is healthcare in Canada any good?

Compared to the standard of healthcare in the US, yes – Canada’s is very good. Canadians spend less per capita than their American neighbours for a system that performs better in several categories such as life expectancy, infant mortality, and maternal mortality.

On a global level, Canada’s healthcare system performs fairly well. In 2019, the Lancet’s worldwide effective healthcare coverage index gave Canada a score of 90 out of 100 points – much higher than the US’s score of 82.

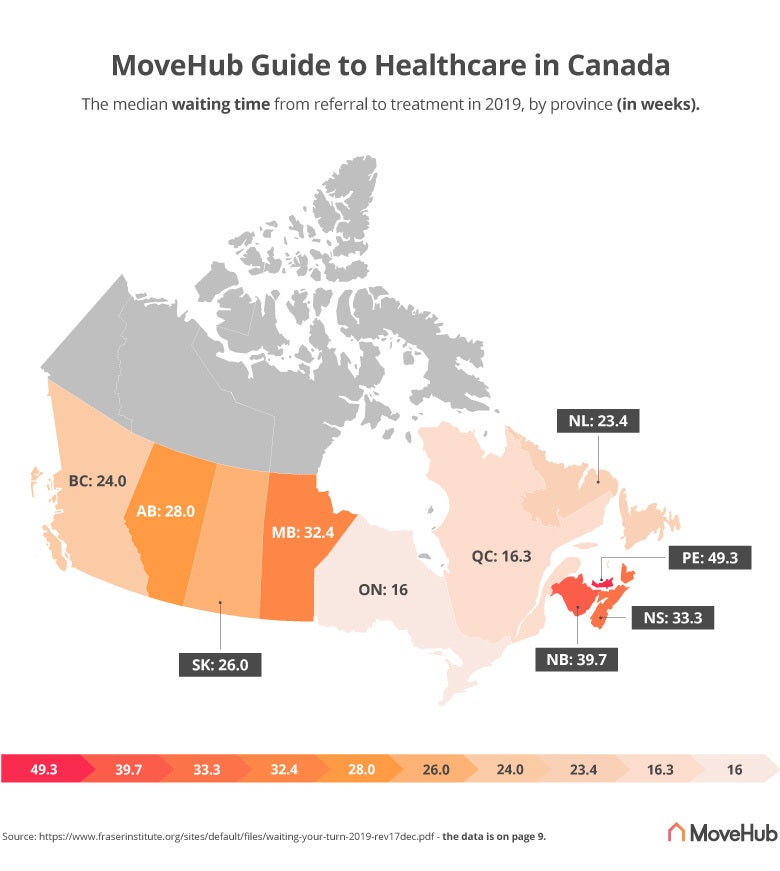

However, waiting times can be a weak point for Canadian Medicare. A study by the Fraser Institute found the median wait time for ‘medically necessary’ treatment in 2019 was 20.9 weeks – 124% longer than the median wait time in 1993 (9.3 weeks), when the annual study began.

As published in the New York Times in 2019, nearly one in five Canadians report having to wait at least four months for elective surgery.

How many people have health insurance in Canada?

All Canadian citizens qualify for health insurance – but given the issues Medicare faces (including prescription medicine costs and waiting times), it won’t surprise you to hear the majority of Canadians have some form of private medical cover, according to a study published by Cambridge University Press.

Private health insurance policies in Canada usually cover things such as prescription medicine, ambulance services, dental care, eye care, physiotherapy, and so on.

About half of Canadians have private medical cover as part of an employer-based ‘group health insurance’ scheme, according to a study in The Lancet.

However, Canadian employers are not legally required to offer group health insurance, so if you’re moving to Canada for work, be sure to check whether your new employer provides medical cover.

If you don’t expect to receive any employment-based health insurance – or if you want something more extensive – you could sort out some cover before you go.

If you think private medical insurance is right for you, start building a customised plan with Cigna. With access to a global network of over 1.65 million trusted hospitals and doctors, Cigna is ready to help.

Who is eligible for free healthcare in Canada?

Quite simply, Medicare in Canada is available only to residents of Canada.

A resident of Canada is ‘a person lawfully entitled to be or to remain in Canada who makes his/her home and is ordinarily present in the province, but does not include a tourist, a transient or a visitor to the province.’

If you’re moving to Canada on a permanent basis (and/or on a work visa), you can apply for a Medicare health insurance card in your province. This will typically take three months to be issued, but once you’ve got it, you’re covered by your province’s Medicare plan.

During this three-month wait for a health insurance card, you could get short-term private medical cover. If you find yourself in hospital needing treatment, you’ll be billed for it – even for emergency care.

Do tourists get free healthcare in Canada?

No, tourists in Canada cannot use the public healthcare system. If you’re just visiting Canada for a holiday or a short stay, you may want to look into private medical cover or travel insurance.

A view of the Toronto skyline, Ontario

Is private health insurance worth it in Canada?

The importance of having private medical cover in Canada obviously depends on your situation. If you’re young, fit and healthy, then you might not be inclined to take out any extra insurance, but it could be a worthwhile expense if:

- You take regular prescription medicine

- You are elderly

- You’ll be travelling between Canadian provinces/territories a lot (explained below)

- Your Canadian employer doesn’t offer any kind of group health insurance

- Your Canadian employer’s group health insurance isn’t extensive enough

- You’re used to receiving medical treatment privately, and wish to continue doing so

What are the benefits of private healthcare in Canada?

- If it’s a case of choosing between a personal health insurance plan and your company’s group health insurance plan, you may want to go it alone. Be sure to investigate what your employer is offering, and find out exactly what you’ll be paying for it.

- You’ll avoid the waiting times associated with Medicare.

- You won’t be subject to the restrictions of some provincial health insurance plans. Most provinces/territories only support residents within their own borders, meaning if you end up in an accident outside of your ‘home region’, you’ll have to pay up. Private medical cover means you won’t have to foot bills in other parts of the country.

- It’s likely you’ll be able to stay in private rooms, and potentially in nicer hospitals.

- You’ll have the peace of mind that comes from having an extra safety net.

How much does health insurance cost in Canada?

On average, private healthcare premiums for a household in Canada cost around C$4,000 per year.

That equates to about C$333 per month.

The average family in Canada will pay C$7,374 per year for public health insurance, according to the Fraser Institute – or C$615 per month – and that payment isn’t optional.

But these are all just averages. To find out exactly how much private medical cover will cost you in Canada, you can start building a customised plan with Cigna and choose from four different levels of annual cover.

Advice for expats moving to Canada

Hopefully the Canadian healthcare system is now a little less hazy for you. Check out more of our Canada pages before your big move!