Guide to Healthcare in Australia

A fresh start in the Land Down Under is an exciting prospect. The weather’s hot, the beer’s cold, and the coastal cities are something to behold.

But before you can focus on the fun stuff, you need to think about the serious stuff – like healthcare. On this page, we’ll tell you everything you need to know about the Australian healthcare system, including the ins and outs of Medicare.

To cut to the chase: yes, private medical cover in Australia is a good idea. More than half of Australians have some form of health insurance, and the country’s public system is pretty stretched.

Want to find out exactly how much a private health insurance policy will cost you and your family in Australia? You can start building a customised plan via Cigna. With over 95 million customers worldwide, Cigna has the reliability and the know-how to get you sorted with the right policy.

Australian Healthcare: Key Stats

- 0% of Australians with health insurance

- 0Average life expectancy

- 0Average no. of days before surgery in public hospital

What’s on this page?

01 | What kind of healthcare does Australia have?

02 | How does Australian Medicare work?

03 | Can UK expats use Australian healthcare for free?

04 | Is it worth getting private medical cover in Australia?

05 | Benefits of medical cover in Australia

06 | How many Australians have private medical insurance?

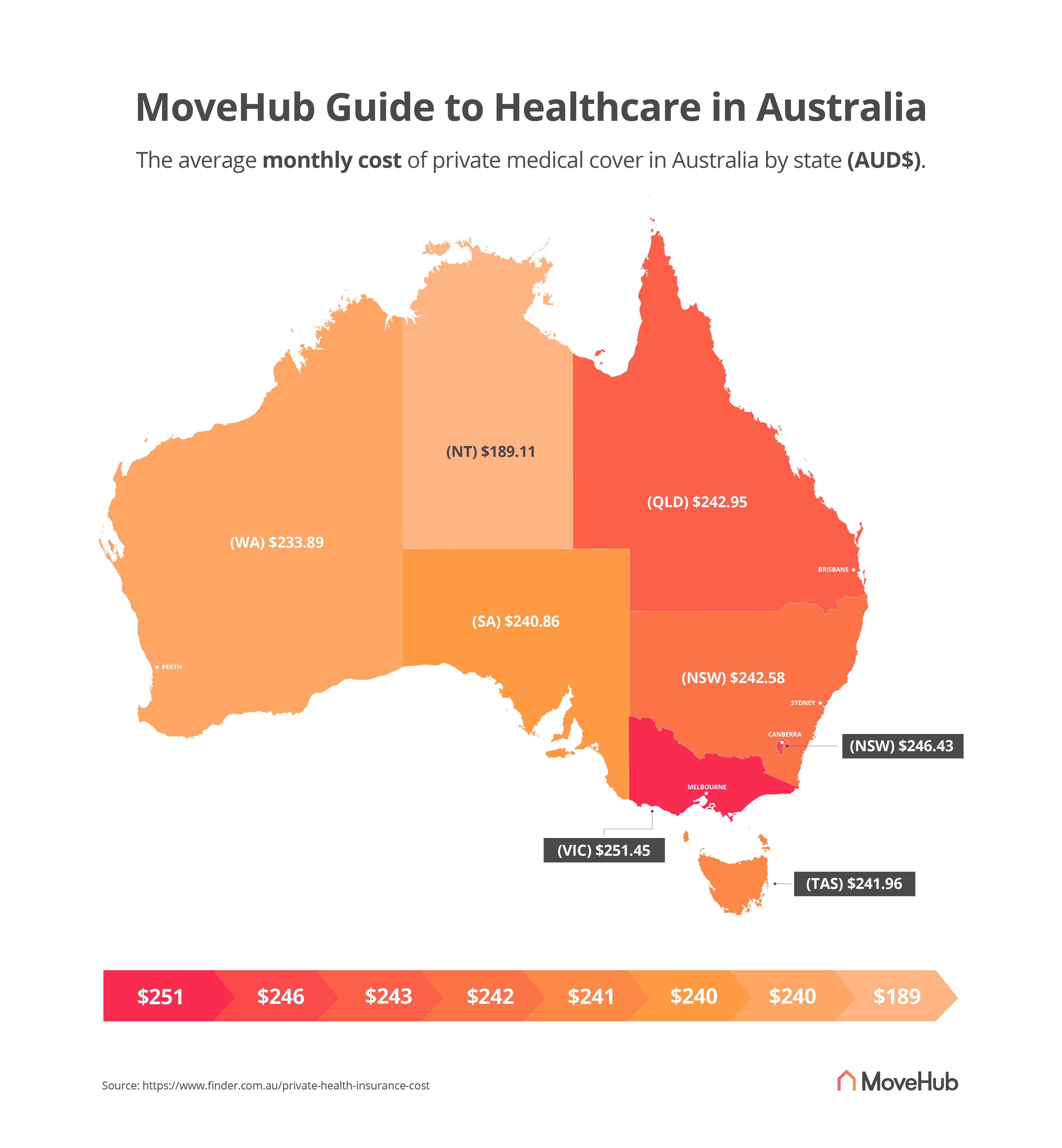

07 | How much does medical cover cost in Australia?

08 | COVID-19 in Australia

09 | Advice for expats moving to Australia

What kind of healthcare does Australia have?

Australia runs on a blend of public and private healthcare.

Australia’s public health system, known as Medicare (not to be confused with America’s Medicare program), provides essential hospital treatment, doctors appointments, and medicine for free – or for a substantially reduced cost. It’s funded by a form of income tax.

The private system, operated by numerous medical companies, comprises additional hospital services, along with specialist care such as dentistry, ophthalmology, audiology, physiotherapy, nursing care, and ambulances.

Unlike the UK, people in Oz rarely rely solely on public healthcare. They typically take out a medical insurance policy so that they can use a combination of public and private healthcare.

It seems to work: 81% of people in Australia think the country’s healthcare system is ‘good’ or ‘very good,’ according to Ipsos – the highest percentage of all 27 countries in the study.

Click on the map to open a larger, zoomable version

So, is healthcare in Australia free?

Sort of. Australia’s Medicare system ensures that healthcare is free at public hospitals, but after that, price tags start to creep in. Certain services and medicines are heavily subsidized, while other things are left entirely for the patient to pay for.

There are also a few services that aren’t covered by Medicare – we go into this in more detail further down the page. Although residents need to pay for these out-of-pocket, the government provides subsidies on certain things through its Medicare Benefits Schedule (or MBS).

Plus, you might also be able to get reduced costs on some prescription medication through the government’s Pharmaceutical Benefits Scheme (PBS).

How does Australian Medicare work?

Established in 1984, Medicare is Australia’s universal health care scheme. It’s available to:

- Australian and New Zealand citizens

- Any permanent residents in Australia

- People from countries with a Reciprocal Healthcare Agreement with Australia, including the UK and Ireland (but not the US).

This means that UK citizens do get free healthcare in Australia, although they will have to start paying income tax if they become a resident (find out more below).

A view of Sydney, where about 20% of Australians live

What does Medicare cover?

If you’re eligible for Medicare, it will cover you for:

- Treatment in public hospitals

- Anything on the government-approved list of medical services, known as the Medicare Benefits Schedule (MBS). Medicare covers 100% of MBS costs if they come from a GP, and 85% of MBS costs if they come from a specialist

- Some of the cost of prescription medications on the Pharmaceutical Benefits Scheme (PBS) list, which names over 5,000 medicines

- Some of the cost of physiotherapy, basic dental care for children, and community nurse services

There are also MBS and PBS Safety Nets, which ensure that you don’t pay over a certain amount each year on specific treatments and medications.

What does Medicare not cover?

- Ambulance services (apart from in Queensland and Tasmania, where ambulances are free to use)

- Treatment in private hospitals

- Most dental care

- Most physiotherapy, audiology, and ophthalmology

- Most psychological and occupational therapy

- Home nursing

- Cosmetic surgery, and any treatment that’s not clinically essential

How is Medicare funded?

Medicare is funded by a tax on income, which for most people is a 2% rate. If you are a resident expat in Australia and you qualify for Medicare, you’ll have to pay the Medicare levy.

However, you might be eligible for a reduction or an exemption, depending on you or your spouse’s economic circumstances.

If you earn less than AUD$23,226 per year – or AUD$36,705 if you’re a senior citizen or pensioner – then your Medicare tax rate may be lower than 2%.

You can use this tool to calculate what your Medicare income levy would be.

What is the Medicare Levy Surcharge?

The Medicare Levy Surcharge (MLS) ensures that people on higher income brackets pay a larger levy. If you earn more than AUD$90,000 each year (or more than AUD$180,000 as a couple), you will have to pay an MLS levy between 1% and 1.5% on your income on top of the standard 2% levy.

You can avoid the MLS by taking out private medical cover. This is essentially why the MLS exists – to push higher income earners into taking out private health insurance. Providing you have sufficient medical cover, you’ll get a code from your insurer which you can enter into your tax return, and this will help you dodge the MLS.

If you think private medical insurance is right for you, start building a customised plan with Cigna. With access to a global network of over 1.65 million trusted hospitals and doctors, you can rest assured you’ll be in the right hands.

Ormiston Gorge in the Northern Territory, Australia’s cheapest state for health insurance premiums

Do expats and tourists have to pay for Australian public healthcare?

If you move to Australia and become a permanent resident there, you will have to pay the Medicare levy on your income.

However, in most cases, people who go to Australia just as tourists or short-term visitors will not need to pay the Medicare levy, and will be able to use Medicare if their country has a Reciprocal Health Agreement with Australia.

For instance, if you’re going to Australia for a working holiday, you will most likely be a ‘foreign resident taxpayer’, meaning you will not have to pay the Medicare levy.

Is it worth getting private health insurance in Australia?

A lot of people moving to Australia have a question to ask: “do you have to buy health insurance?”.

There is no “have” about it. Ultimately, you are not legally obliged to take out medical cover in Australia, but it is a very good idea (almost 55% of Australians have some form of private medical insurance).

What does Australian medical insurance typically cover?

- Hospital treatment

- General treatment (also known as ‘Extras’ or ‘Ancillary’ in Australia, this is treatment that would typically happen outside of hospitals, such as dentistry, physiotherapy, audiology, and ophthalmology)

- Ambulances (yes, ambulance transport costs money down here, apart from in Queensland and Tasmania where it is free)

This is why most private medical insurance is divided into two categories: hospital cover and general cover. When it comes to choosing one or the other, general cover is more common (given Medicare covers hospital care quite extensively), but many people tend to opt for both.

What are the benefits of private medical cover in Australia?

No Lifetime Health Cover charge

The Australian public healthcare system is obviously not suitable for the entire country’s population to rely on, and the Australian Government recognises this. The Lifetime Health Cover (LHC) charge is one such way to push people into taking out private medical cover.

How does it work? Well, if an Australian doesn’t take out adequate medical cover before the 1st of July after their 31st birthday, they will face a 2% increase in their premiums every year from then onwards. This can tot up to a 70% surcharge by the time you’re 65, but it doesn’t increase beyond this point.

The LHC does not apply to new migrants, providing they take out private cover within 12 months after registering for Medicare. So, if you do plan to take out private medical cover for your move to Australia, it’s best to do it sooner rather than later.

No MLS

As we mentioned further up the article, if you’re a higher income earner (i.e. over AUD$90,000 per year), you can avoid paying the MLS by taking out medical cover.

Shorter waiting times

Like all public healthcare systems around the world, Medicare makes people wait for treatment. The most recent study by the Australian Institute of Health and Welfare (AIHW) showed that 50% of patients in 2020-21 had operations within 48 days, up from 39 days in the previous year.

Plus, 71% of ‘emergency’ patients were seen within 10 minutes (the recommended time frame for emergencies in Australia).

Comfort and peace of mind

This one applies to private medical cover all over the world. If you go private, you can choose your own hospital and doctor (from those affiliated with your provider), and you don’t have to worry about dealing with huge medical bills. Plus, you’ll likely have your own private room, which is rarely available in public healthcare.

Most importantly, you’ll have peace of mind that you can get good quality care as and when you need it.

How many Australians have private health insurance?

It’s common for expats to base their lifestyle decisions in their new country on what the locals do. When in Rome!

Well, when it comes to private health insurance, the majority of the Australian population have decided it’s a sensible purchase. According to the Australian Prudential Regulation Authority (APRA), as of December 2021, more than 14 million people in Australia have general treatment cover (54.7% of the population).

Meanwhile, more than 11.5 million people in Australia have hospital treatment cover (45% of the population).

How much is private health insurance in Australia?

On average, the cost of private medical cover for an individual in Australia is AUD$157 per month (according to Finder).

In terms of ‘per year’, that’s roughly AUD$1,880 for hospital treatment cover.

Based on the study, the most expensive state in Australia for health insurance is Victoria, at AUD$258.77 per month for a gold policy.

The least expensive state is the Northern Territory, at AUD$66.57 for a basic package.

Want a better idea of how much private medical insurance will cost you and your family in Australia? Start building a customised plan with Cigna.

Private Health Insurance Rebate

Fortunately, to help you with the cost of private medical cover, the Australian Government provides a rebate at the end of each tax year. However, it does depend on you having an ‘appropriate level’ of medical cover, which you can learn more about here.

The scheme is income tested, so the higher your income, the lower the rebate you’re entitled to. Use the official Private Health Insurance Rebate calculator to see how much you’d be owed each year.

Mind the gap

When it comes to healthcare costs in Australia, you should also be mindful of ‘the gap’. This refers to the difference between a doctor’s fees, and the amount that your health insurance will cover you for.

Crucially, private medical insurance in Australia does not cover services that are already covered by Medicare, such as specialist consultations and diagnostic tests in public hospitals. However, Medicare doesn’t always cover the full cost of these services, leaving you with a remaining fee to pay.

The Australian Government provides a list of suggested ‘reasonable’ prices for every treatment and medication on the MBS and PBS (discussed earlier), but no doctor is obliged to adhere to these prices. If a doctor charges above the recommended fee – and Medicare doesn’t cover the full cost of a treatment or medication – you will have to pay the remainder.

Some health insurers have ‘gap cover’ arrangements as part of their policies, but unfortunately, not every treatment/medicine is eligible for gap cover.

COVID-19 in Australia

With the help of emergency measures, strict rules, and public enthusiasm, Australia kept COVID-19 case and death levels low for the first 20 months of the pandemic.

Then on 1 November 2021, Australia lifted all its lockdowns.

Unfortunately, the Omicron variant led to a spike in cases and deaths in January, with twice as many people dying in Australia during this wave than in the rest of the pandemic.

However, the wave seems to be ending, with the number of cases and deaths falling rapidly – and an overall total of 5,736 deaths in a country of 25.7 million is a much better rate than most other countries.

For instance, it’s 11 times better than the UK.

Advice for expats moving to Australia

Hopefully you’re a little clearer on all things healthcare in Australia. It’s a complicated system, but sort yourself out with the right level of cover and you’ll be tickety-boo.

Check out these guides to find out more about life in Oz: